Trade on Binance Futures using Signals

When futures trading began in late 2017, no one ever imagined that it would grow so fast and even be at par with spot trading. But three years down the line, futures trading is not amounting to half of the value of more traditional buy-sell crypto trades, as reported by Bloomberg. Spot trading crypto is the buying or selling a crypto asset at the moment of the trade. Before futures trading was launched through Bitcoin (BTC) futures platform, spot trading was the principal option available for crypto trades. The first entity to launch Bitcoin futures trading was Chicago Board Options Exchange (CBOE), which launched the first-ever BTC-based futures contracts on December 11, 2017. Afterward many exchanges followed suit and launched futures trading of various cryptocurrencies.

As a new trader, you may be worried about not being able to make money as a crypto newbie. But there are more opportunities even for a newbie because being new to crypto does not necessarily mean you can’t make a profit with future trading.

Binance Futures using our best signal providers

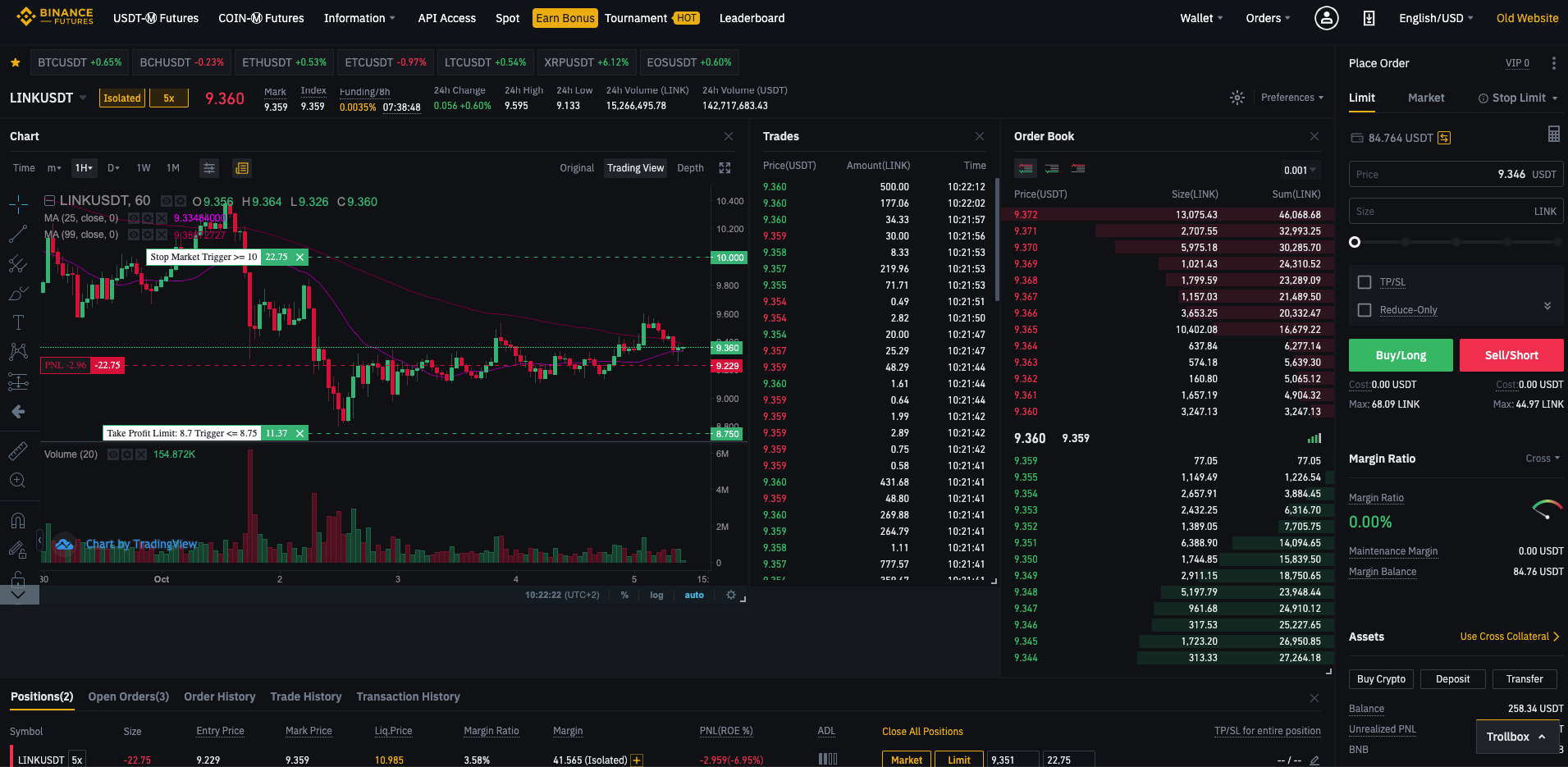

When Binance recently launched a futures trading platform, Binance Futures, the aim was to give traders the opportunities to use leverage and to open both short and long positions. We had a first look and test of the Binance Futures platform, and we can say that the platform is largely similar to that of Binance’s spot exchange, making the trading very easy. The user experience is also quite smooth, and trading is equally simple.

Which Cryptocurrencies do Binance Futures Support?

Binance Futures have expanded the variety of trading pairs since its launch. At the time of this writing, the platform offers up to 75x leverage trading of the following pairs:

- Ethereum (ETH)/USDT

- Ripple (XRP)/USDT

- Binance Coin (BNB)/USDT

- Bitcoin Cash (BCH)/ USDT

- Cardano (ADA) / USDT

- Stellar (XLM) / USDT

- Tron (TRX) / USDT

- EOS / USDT

- Litecoin (LTC) / USDT

- Ethereum Classic (ETC) / USDT

- Chainlink (Link) / USDT

- Monero (XMR) / USDT

- Dash / USDT

- Zcash (ZEC) / USDT

- Tezos (XTZ) / USDT

- Cosmos (ATOM)/ USDT

- Ontology (ONT)/ USDT

- Brave (BAT)/ USDT

- VeChain (VET)/USDT

- IOST/ USDT

- QTUM/USDT, etc.

How to trade on Binance Futures

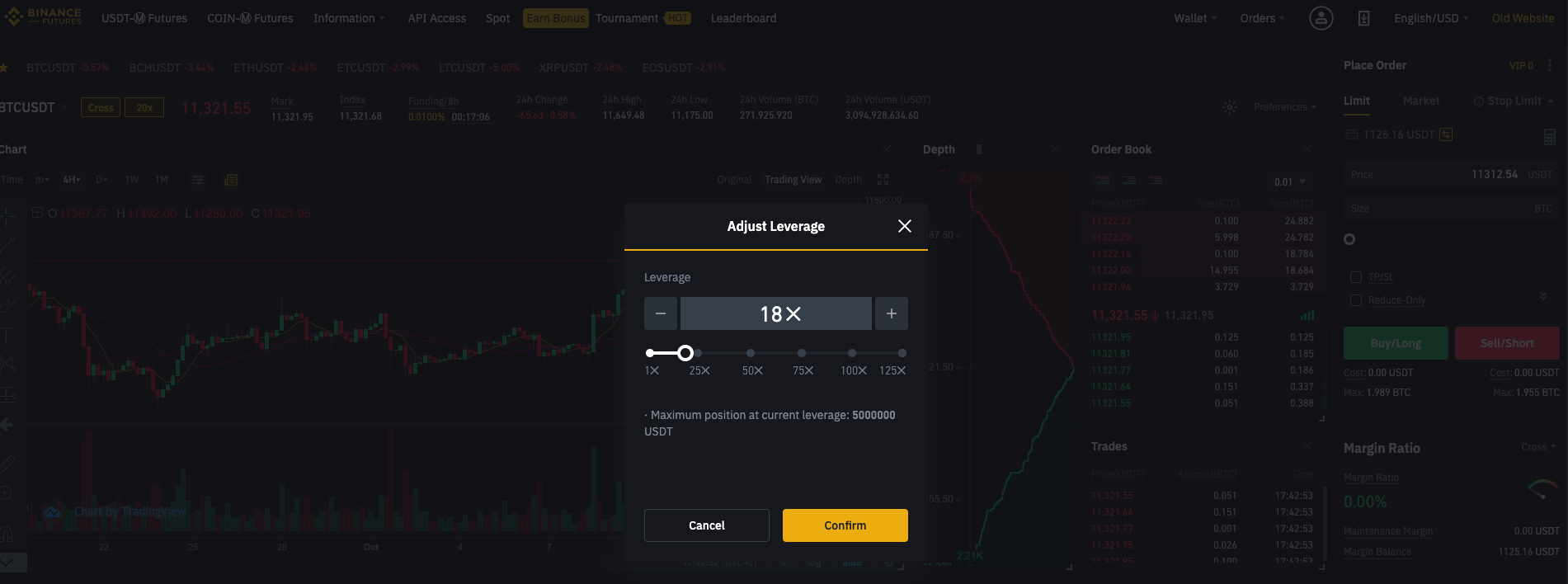

The good thing with Binance Futures is that it allows you to trade with a leverage of up to 125x. The simplified setup can facilitate your leveraged trading experiences. If you check on the top left corner there is a button right next to the BTCUSDT symbol that if you click will allow you to adjust your leverage accordingly.

You can use the slider to set your preferred leverage, which can range from 1x to 125x. A case in point is where you decided to use 200 USDT with leverage of 100x, this will open a position worth $20,000, which means you’d only post $100 USDT as a margin.

Trading Binance Futures with Binance Signals

As a futures trader, it is not just enough to say you want to do it. Take note that futures markets have the highest failure rate among novice traders. On the other hand, futures provide traders with big the ability to trade with unparalleled margin. The secret is the ability to read the market pulse, which can lead to a personal semiautomatic money machine. But this is not easy as there is more than meets the eye.

When you receive trading signals from Binance Futures Signals, you could use it for finding safe entries into longer-term plays on the Binance exchange. Watch out for a possible stock investment with the potential to grow in the future and enter the market. There is a higher probability that your favorite long-term stock will go up with the trend. However, ensure you use an extra tight stop loss.

The basic Binance futures trading principle is to combine a relatively cheap entry price with momentum in the right direction. It is this combination that will give you the advantage as a trade, which is a necessity when using the stop loss method. If you can use stop loss without being killed by the many small losses then you’re able to take on futures trading. In that case, using stops puts you almost automatically on a trend. This is the basic secret to trading on the trend, which requires you to keep the small losses in check through stop-loss features. Futures traders who have specialized in ongoing trends is likely to win on Binance Futures trades if they use Binance futures signals well.

You will realize how trading futures on Binance is simple if you are armed with the right signals from Binance Futures Signals. Binance only allows trading BTC/USDT with up to 125x leverage, and up to 75x for other cryptocurrencies.

The Binance Futures exchange offers leverage to up to 125x and offers support for cross or isolated margin, amazing to have with all the other tools you need .

When you are armed with the trading signals our providers post, you have four types of orders that you can place on the platform:

- Limit Order: used when you want to buy at a specific price.

- Market Order: these are the most basic order type, which is mainly used to buy Bitcoin at a spot price.

- Stop-Limit Order: these are used as a stop-loss mechanism, but not necessarily always.

- Take-Profit-Limit Order: this is mainly used to set the price at which you wish to collect your profit.

Opening positions on Binance Futures

Opening a Short or Long Position

This involves the use of Limit orders, which are used when you want to buy at a specific price. Setting a limit order requires that you specify the price at which you want to buy or sell. On the Order Quality tab, input the amount of BTC that you wish to buy. Your position is opened as soon as you hit the “Buy/Long” button.

Closing a position on Binance Futures Trading

When your position is opened, you will be able to monitor its status on the Binance Futures platform. However, you are provided with two options if you want to close the position.

As you will notice, the position tracker also contains a liquidation price. This is the price that, if reached, will see your position liquidated due to insufficient margin. Remember that the entire amount in your futures wallet is used as collateral. Consequently, if the price movement does not go according to your trade, the platform will use your remaining capital as collateral. But the moment you hit the “Market” button, your position will be closed and you will see the funds returned to your margin account.