Altcoin signals for Binance Spot and Futures

What are altcoins

You may be wondering: What are altcoins? Altcoins are Cryptocurrencies that are not Bitcoin. These are other forms of the digital currency. There are also Stablecoins and Security tokens. Let’s go over what they are and how they differ from Bitcoin. Also, we’ll cover some of the top exchanges that list altcoins. In the end, you’ll know which ones to invest in!

Stablecoins

While the value of bitcoin has overshadowed many other cryptocurrencies, altcoins are growing rapidly in popularity. They combine the advantages of cryptocurrencies with the safety and privacy of fiat currencies. They also offer price stability for traders. Stablecoins are tied to an external asset, such as gold, silver, or a company’s stock. This means that they can remain stable even as the price fluctuates.

The main purpose of stablecoins is to provide investors with a more reliable investment option. However, while altcoins are largely independent entities, they are still backed by some type of asset. Stablecoins have the advantage of minimizing time and energy because they are backed by a certain amount of money. Unlike altcoins, stablecoins can be a safe bet in times of market instability.

Security tokens

What is the difference between security tokens and altcoins? To put it simply, security tokens represent shares of a company, not an individual’s money. They also benefit from the speed and security of blockchain technology, and regulatory measures by governments to protect investors. In addition, the Securities and Exchange Commission regulates securities offerings, which means security tokens comply with all of the SEC’s requirements. These regulatory measures help protect investors from fraud and other malicious actors.

While security tokens are often referred to as altcoins, they are actually securities, gaining popularity as a bridge between the blockchain and traditional finance industries. They are a natural fit, as they are beneficial to both sectors. In addition to being a great alternative to fiat money, security tokens also represent shares in traditional assets like real estate and equities. In addition to that, many blockchain projects have created platforms that directly undercut the old ICO model by tokenizing equity rights in pre-IPO companies.

Cryptocurrencies that aren’t Bitcoin

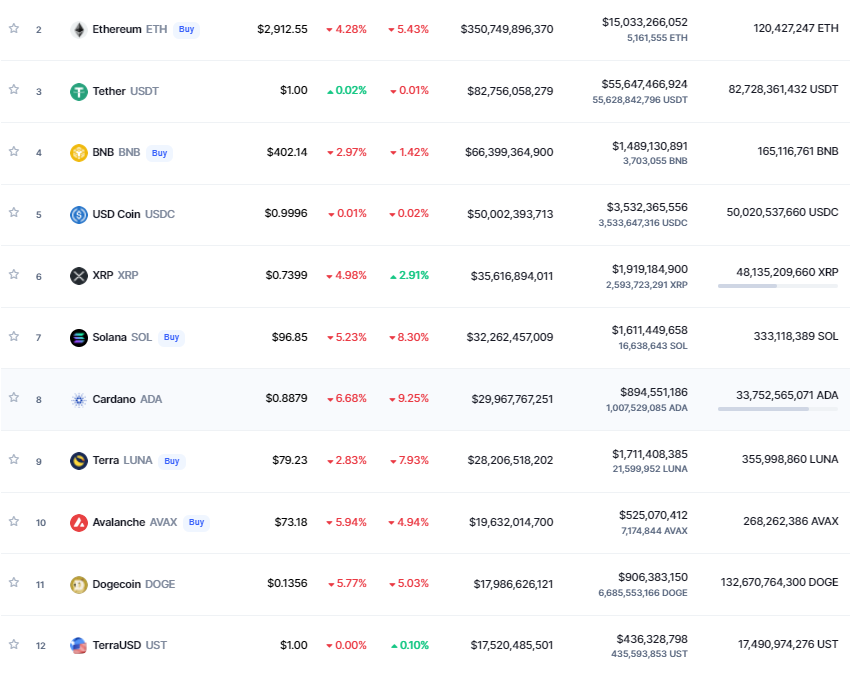

There are more than 3,000 altcoins (cryptocurrencies not Bitcoin). Prices for these varying cryptocurrencies typically follow that of Bitcoin. Buyers purchase Bitcoin with fiat currency and then exchange it for the respective altcoin. Bitcoin is the first cryptocurrency, and a popular one, and accounts for around 40% of the total crypto market cap. But altcoins aren’t all created equal – some are worth pennies, while others can command hundreds of dollars. Some altcoins aim to build upon the success of Bitcoin, while others claim to solve some of the problems associated with the popular crypto currency.

One of the main problems with Bitcoin is its volatility. Bitcoin is volatile, and it is difficult to make daily payments. However, Bitcoin Cash was designed to be a more stable currency for everyday use, but its volatility makes it a terrible choice. Its current market cap is $9 billion. Although it is not as popular as Bitcoin, it is the most liquid altcoin. It is a good investment, but it is not worth as much as Bitcoin.

Cryptocurrency exchanges that list altcoins

While most crypto exchanges list some altcoins, the specific types of coins available on each vary from exchange to exchange. Some offer interest-bearing accounts and pre-approved lending, while others have a social media component where users can communicate trading ideas. Cryptocurrency exchanges that list altcoins are a good starting point for altcoin trading. The following are some of the most popular exchanges that list altcoins.

Coinbase, Binance, and Kraken are the largest exchanges for listing and trading altcoins. These exchanges generally feature lower fees than their larger counterparts, but the fees can add up over time. Keep in mind that larger exchanges are generally more trustworthy and regulated, which means less privacy for users. Also, be sure to consider the amount of security offered by each exchange before investing in a particular currency.

What are altcoin signals

Trading signals are signals that are generated by a professional analyst or trading bot. These signals provide traders with all the information needed to make a profitable trade before the rest of the market. They are especially helpful for beginners who are unfamiliar with volatile markets. Good trading signals tell you what price to buy and sell, how much leverage to use, and where to set your stop loss and take profit. These signals are sent by email, text message, and other communication channels.

Typically, a trading signal calls for buying or selling a specific currency. It also includes a stop loss signal, which represents an exit point from the trade in order to protect the trader from losses. Another signal, known as a take profit signal, calls for the opposite action, or exiting the trade at a profit level. This signal is activated once the profit level reaches a set rate. It is best to consult with an investment advisor before relying on a trading signal.

While trading signals may be useful, they cannot guarantee profits. You may lose your entire investment if you follow the wrong recommendations. Signal providers are not free, they invest time and money into producing and marketing signals, and they may be worse traders than you. You should also consider their experience level. Some providers are more reliable than others. And remember that not all signal providers are the same. So, make sure to do your due diligence and choose only reliable providers, check our top 10 reliable telegram crypto channels .

In addition to learning about the best trading signals, you must also learn about the key differences between leveraging and spot trading. These concepts will help you decide whether to trade in a short-term or long-term fashion. Also, be sure to join signal groups that practice proper risk management. Incorrect risk management can lead to disastrous results. A trading signal should be based on proven techniques to strike a fine balance between risk and reward.

Trading signals are generated by various sources. One of the most popular sources is technical analysis. This technique uses mathematical patterns to predict market trends. Technical analysis also uses candlestick charts and other indicators to identify potential triggers. Fundamental analysis, on the other hand, relies on aspects of the market that have nothing to do with price action. This is why it is important to have a sound understanding of both types of signals. It is important to choose a trading signal provider who offers reliable signals and understand the difference between automated and manual methods.

Trading signals are recommendations and ideas from an expert team. They are based on mathematical algorithms and human analysis. These signals can improve your trading practices and allow you to extend your profit margins. Manual signal providers include professional traders, market analysts, and strategists. They also offer a formulated technique or strategy. If you are interested in learning about the best signals for your trading style, be sure to read the provider’s website carefully. Not all trading signals are profitable, so it is important to know what you’re getting into before implementing them.

Binance Futures profitable signals

When it comes to trading on the Binance exchange, you can take advantage of free and paid binance signals. The latter are considered to be the best options. Although free signal platforms may offer quality trade calls, they cannot compete with paid signal providers. As a newbie in the crypto community, it’s advisable to learn as much as you can about the basics of crypto trading before choosing a signal provider. In this article, we’ll look at some of the most popular options and their benefits.

The first step in choosing the best signals is to make a shortlist of the top providers of binance signals. You can conduct a Google search and look for reviews and feedback from users. Make sure you choose a provider with experience in the crypto market. It is also important to find a reliable, consistent signal provider. In addition to being reliable, a reliable signal provider should be able to communicate with the broker on a daily basis.

You can also check reviews online to find the best providers for crypto signal subscription. Many of them claim to be the best in the industry and include pictures that they created themselves. It’s always a good idea to look for a provider’s success rate before signing up for a subscription. Make sure to check the success rate, as past results do not necessarily predict future performance. A provider’s success rate should be high. If their results are consistent, you can consider using their service.

When it comes to choosing a signal provider, you should consider the pros and cons of each one. The most important thing is that the signals provider has a proven track record of making profitable trades. You also want to choose one that offers education. That way, you’ll learn how to read charts and make informed decisions. This will allow you to make better decisions in your trading. If you are a beginner in the crypto world, you may want to start by learning about crypto signals.

If you’re looking for a reliable crypto signal provider, try 2Moon. It’s a Swiss-based team of professionals who analyze market data and cryptocurrency announcements to identify the right entry price. Their signals are consistent, with over 80% accuracy. You’ll be surprised at how much better you’ll make your trading experience if you subscribe to twoMoon. And don’t worry about signing up for a subscription because the fees are based on the value of Bitcoin.

Before buying or selling, you should also know the timeframe of the trade. A signal provider will typically state the timeframe of each trade. Short-term trades, for example, are best suited for those who want to follow a trend. Conversely, medium-term and long-term traders are most likely to invest in a certain market for a prolonged period of time. The timeframe will affect the risk associated with the trade.