Binance Options Vs Futures

In this article, we’ll discuss the costs of a the difference between Binance options vs futures trading. We’ll also discuss the liquidity and leverage offered by both options and futures. Ultimately, you’ll be better off making a decision based on your own experience, and the knowledge of the market and the pros and cons of each. Read on to find out more! But first, let’s get some basics.

Price of a call or put option

A call or put option is a financial contract that has a reduced risk of losing money compared to traditional Binance futures. Binance options use a strike price, minus the premium, to determine the success of a trade. Depending on which option contract you choose, the premium may differ from what it means on other platforms. The premium will determine how much the trader will lose, and is a crucial aspect to consider when choosing Binance options.

While traditional options products offer a variety of strike prices and expiration dates, Binance Options are only available through Binance. That means that holders are not exposed to unlimited downside. This means that traditional options products offer hundreds of different underlying assets, resulting in fragmented liquidity landscapes. In addition, trading with illiquid contracts may pose a challenge to both transaction costs and trade execution. By comparison, the price of a call or put option on Binance is a fraction of the cost of a traditional option.

When you buy options on Binance, you must make sure you have sufficient free margin to ensure that you’ll never lose money. When a market goes your way, the premium is deducted from your account, but the profits are added back into your account. With no limit to profit, the premium paid must be more than the price of the underlying asset to make a net profit. In order to make money from a call or put option on Binance, you must earn more than the premium paid.

While Binance Options offer many benefits, they do have a few disadvantages. First, they can be difficult to navigate, but the user interface is a lot more intuitive. Once you get a feel for the options platform, you’ll find it a rewarding platform for trading. The interface is easy to use and well-labeled, and advanced traders will find it easy to operate. A call or put option on Binance is a good choice for novice traders as it offers greater flexibility and less risk than a binary option.

Cost of a futures contract

The cost of a futures contract on Binance can vary depending on the length of the trade and the level of leverage. The firm offers leverage of up to 125x. The cost of a futures contract on Binance also includes an interest rate to short sellers. This interest is paid every eight hours and is usually 0.01%. The funding rate is important when you are trading both long and short positions.

The maker and taker fee rates on Binance are competitive. The initial taker fee is 0.04%, while other exchanges charge much higher fees. The maker fee is equal to the maker fee on Kraken, Huobi, and OKEx, which is also 0.02%. If you want to make a profit on Binance, you can calculate the cost of a futures contract by entering a few values, such as the quantity and the fee rate.

The quarterly contracts on Binance are ideal for hedging strategies because of their liquid nature and low funding fees. They are also perfect for long-term position traders and miners because they have the lowest taker and maker fees in the market. A good futures contract can help you make money while taking risks. There are a number of advantages to futures trading, including leverage, transparency, and big brand recognition.

A good futures contract on Binance can be an excellent way to begin trading. With low taker fees, it is the perfect place to get started. And it is also possible to set limit closes and liquidity limits for your position. Once you know how to trade in futures on Binance, you can start trading with confidence. It is important to understand the different trading options and how they work before deciding which one to trade on.

Liquidity of a futures contract

To trade on Binance, you must register for an account first. After completing your identity verification, you must choose a platform, such as USD or crypto. If you choose to trade on crypto, you can avoid using stablecoins. You should choose a currency that is volatile, such as Bitcoin or Ethereum, because they are correlated with their value. However, if you do choose to trade on USD, you should know the risks associated with this strategy.

The value of collateral can fall below the maintenance margin, causing the trader to lose his or her entire account. The price of liquidation varies depending on the risk and leverage of each user. Higher risk involves a higher margin, so the larger the total position, the more liquidation will occur. To avoid losing money, you should consider liquidation as a backup strategy. While it may be tempting to try to make a quick profit, you should consider taking your time and making a trading plan.

Market orders on Binance Futures are the most basic type of order. If you want to buy or sell an asset at its current price, a market order is essential. To place a market order, you must enter the quantity you want to buy or sell. A limit order, on the other hand, is a limit order with a stop price. Limit orders are only placed once the stop price is reached.

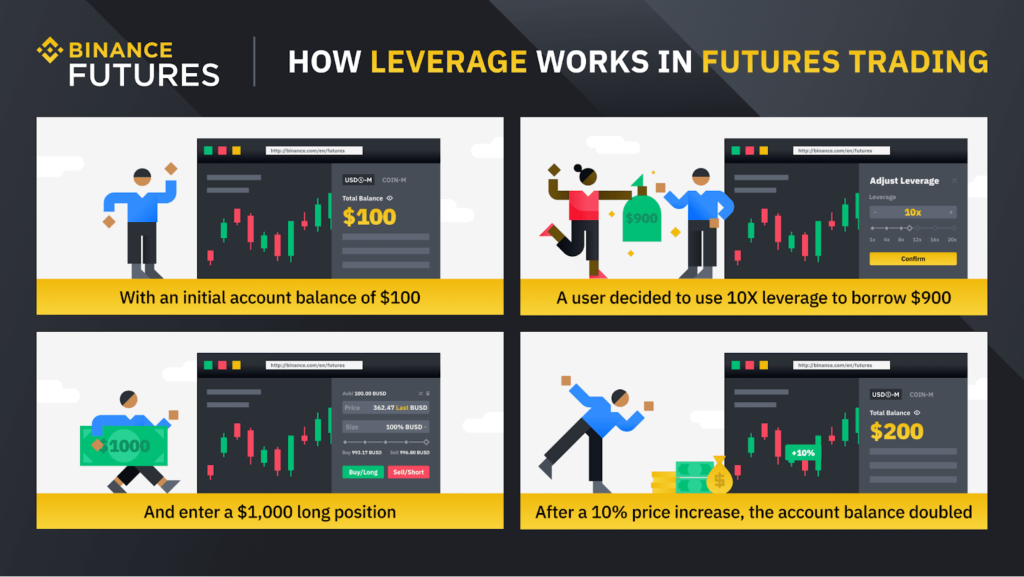

While it is important to note that futures trading is not for everyone, it does provide a variety of advantages over conventional cryptocurrency trading. Futures trading allows traders to benefit from leverage trading. This allows for a small trading budget and the potential to earn significant profits from small fluctuations in the market. If you want to trade on the Binance Futures market, it is important to use a platform with low maker/taker fees.

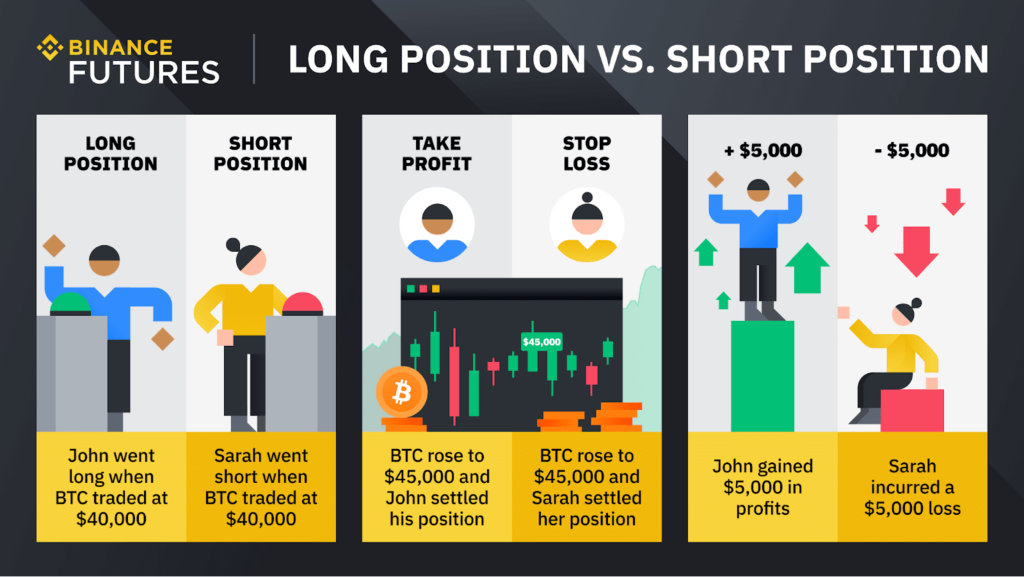

Leverage offered by a futures contract

Leverage, or the amount of leverage a trader can use to increase the size of their position, allows traders to open a position larger than their trading capital. The leverage offered by a futures contract on Binance can range from 20x to 125x, but traders can manually adjust their leverage for each individual contract. By default, the leverage is set to 20x for BTCUSDT. To increase the leverage amount, traders should move the slider and then confirm it.

Binance futures trading supports high leverage, and leverages can be as high as 125x. However, customers should be aware that they must pay interest to short sellers every eight hours. This fee is a necessary expense, since the more leverage a trader uses, the larger his position will be. Leverage is calculated by the notional value of the contract. The higher the notional value of a position, the higher the leverage.

As of July 19, the maximum leverage offered by a futures contract on Binance has been lowered to 20x for existing users. New users were initially limited to 20x leverage, but the limit is gradually increased for all users. The change comes after a recent New York Times article criticizing high-leverage trading in crypto. The article cited Timothy Massad, the former SEC chairman, as stating that leverage was too high for many users.

Another advantage of the Binance futures exchange is the ease of use. Unlike traditional cryptocurrency exchanges, the Binance futures platform is designed to be as advanced as institutional platforms. The platform features several advanced order types that allow traders to enter and exit trades in the most efficient way possible. With a small trading budget, you can make significant profits by using a relatively low investment amount.

Avoiding drawdowns when trading a futures contract

One of the most important things to consider when trading a futures contract on Binance is liquidation. Liquidation is the automatic conversion of assets into cash, and it is a risk you need to avoid. Leveraged positions are prone to sudden price swings and losses that can exceed your maintenance margin. Liquidation may occur gradually or rapidly, depending on the leverage.

To avoid this kind of situation, be proportional to your funds. Futures contracts can result in large losses if your initial capital is not large enough. As a new trader, you should not overextend yourself by trading multiple contracts at a time. Also, avoid using all of your account’s money at once. A small account can be a valuable accomplishment, but don’t trade more than you can afford to lose.

Never let emotions affect your decisions. Avoiding emotions while in the market is crucial because it can lead you to hold losing positions for a longer time than necessary, or exit profitable positions prematurely. To keep your emotions in check, follow the guide provided by Binance. As a new trader, it is vital to keep these things in mind to ensure success in your trading. If you follow these tips, you’ll be well on your way to becoming an expert trader in no time.